This new high on overall e-commerce penetration is partly owed to new customer groups that have traditionally been reluctant to move online. As a result, the e-commerce industry is larger than ever – the “cake” has been expanded. However, continuing these levels will be extremely difficult, and we foresee that only the most professional e-commercers will be able to continue growing in the coming years.

What many e-commercers have forgotten is that a year and a half ago, competition was already increasing, and growth rates were lower than many were used to in the first waves of the e-commerce era.

As a result, it is not surprising that growth rates are now declining to more moderate levels – and not just because physical stores have opened again or because of the difficulties getting access to goods due to the global supply chain situation. Companies are back to looking at areas that are tougher to affect in order to improve or sustain growth.

With Coronavirus starting to be in the rear-view mirror, the question is: Were your e-commerce strategies strong enough to continue your growth trajectory, or were you just lucky? If your growth is suddenly disappearing, you were probably just sailing along in the strong corona wind, and thus, lucky. The good news is that you only need to focus on the things that are moving the needle in e-commerce to progress from luck to being a top-performing e-commerce professional. Another piece of good news is that most of your competitors aren’t really there yet either.

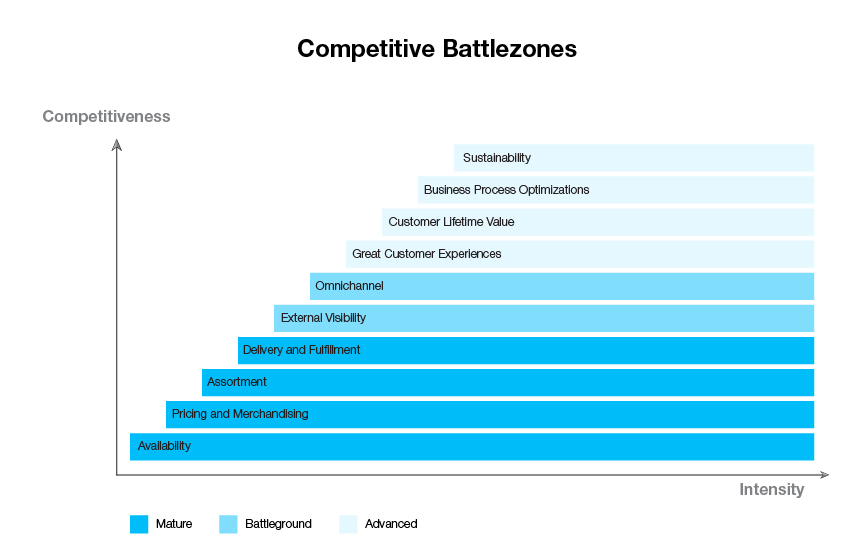

Before we jump into describing each battle-zone, the graph should be read as the 10 battle-zones that open up as market intensity increases. The more battle-zones that are open, the more pressure (headwind) e-commerce organizations will face. Finally, each battle-zone evolves individually, yet they remain a battle-zone, meaning these are areas where companies will need to continuously focus.

Before we jump into describing each battle-zone, the graph should be read as the 10 battle-zones that open up as market intensity increases. The more battle-zones that are open, the more pressure (headwind) e-commerce organizations will face. Finally, each battle-zone evolves individually, yet they remain a battle-zone, meaning these are areas where companies will need to continuously focus.