novembro 08, 2024

An omnichannel strategy ensures consistent and relevant customer interactions across all channels, regardless of location. Delivering such experiences is crucial, as 75% of consumers now expect consistency.

With an omnichannel strategy taking the APAC region by storm, it’s intriguing to see how this approach was seamlessly embraced into the region’s new normal post-COVID. In Singapore alone, the market’s omnichannel spending accounted for 57.6% of retail spend in 2022. According to a study from GlobalData, such spending will continue to grow well beyond 2026.

This article will explore the essentials of omnichannel customer experiences — their definition, significance and key advantages. We'll also provide expert tips for launching a successful omnichannel strategy tailored to your brand's unique needs.

The phenomenon of unified commerce

The omnichannel experience trend had seen large growth. Some attribute it to an advancement in technology, while others point to a change in consumer preferences in response to the pandemic — when movement was limited and online shopping became the new normal. This shift pushed retailers to find ways to repurpose their brick-and-mortar presence for more phygital experiences.

While these arguments are familiar, they often lack clarity on why the omnichannel approach has gained such traction globally, particularly across the Asia-Pacific region.

In our last article, Luxury Retail done the Asian Way, we briefly discussed this phenomenon, highlighting that for luxury retail brands to better serve their Asian consumers a seamless omnichannel approach is the ideal solution. The Asian consumer had graduated from a transactional relationship to a more intimate one; they now expect a personalized experience.

The data points behind this wave of unified commerce in the APAC region shed light on the trend.

Data points

According to a McKinsey report, consumers in the APAC region are shifting their shopping behaviors by switching brands, adopting new digital approaches and opting for private-label products, with over 60% driven by the pursuit of better value. Quality and novelty also influence their choices. In China, 86% of consumers are shifting towards value, an increase from the previous quarter. However, in Japan, consumers are slower to change, showing more brand loyalty and sticking to familiar shopping methods.

The demand for omnichannel shopping is particularly notable in South Korea, China and India, where consumers actively use a wider variety of channels. In these countries, over 50% of consumers expect to use multiple shopping channels across all categories, with the exception of vitamins, supplements and over-the-counter medicines in South Korea.

The Zero Consumer

In our previous article, we discussed Asian consumers who love luxury and are tech-savvy. In the retail and consumer goods realm, they are known as the ‘zero consumer’, a term coined by McKinsey. Like their luxury retail counterpart with a few distinct nuances, it is not hard to identify them. They simultaneously save and spend an exorbitant amount, value health and have a passion for sustainability.

The demographic heart of the zero consumer group beats strongest among Millennials and Gen Z — generations already recognized for their impact on societal norms and economic trends. These younger consumers are digital natives, effortlessly blending online and offline worlds in ways previous generations haven't.

However, like their luxury counterparts, if retail brands don’t pay close attention to these consumers, they will lose out to the competition.

Zero loyalty

Zero consumers rarely pledge their allegiance to brands, prioritizing their needs and preference over loyalty.

In August 2023, a survey by McKinsey revealed that 63% of Australian consumers had adopted new shopping habits, such as visiting different stores or trying new brands, in the past three months. This trend is even more pronounced in India (87%), China (83%) and South Korea (67%). While availability was key during the pandemic, consumers today seek value, quality, variety and, increasingly, purpose. Value is particularly crucial, with 82% of Indian consumers switching to different retailers or brands for better value, such as lower prices or delivery fees, followed by 61% in China and 76% in South Korea.

Zero boundaries

Consumers demand the full ‘phygital’ experience — seamlessly blending physical and digital offerings to create interactive, consistent experiences as revealed in McKinsey's insights on the future of omnichannel shopping. According to a study conducted by Selligent Marketing Cloud, 40% of Gen Z consumers still valued the in-store experience compared to browsing online since the pandemic, a stark contrast to their millennial counterparts despite growing up with technology.

As tech enthusiasts, Asian consumers demand in-store experiences that offer convenience and accessibility, or an extraordinary customer journey down to the smallest touchpoint. Being phygital themselves, they reject restrictions and prefer flexibility, desiring a plethora of options to choose from and seamlessly transitioning between platforms without barriers, carrying their information wherever they go.

Seamless transactions

For the omnichannel shopper, a phygital experience extends to all touchpoints, including payment methods. In the Asia-Pacific region, omnichannel payments have become almost the norm, with some countries evolving their payment options more rapidly than others. China gained a first-mover advantage by introducing WeChat payments as early as 2011, sparking a digital revolution and positioning itself far ahead of its Asian counterparts.

What’s next?

In this environment, where differentiation is minimal and consumers deem all brands the same, companies must find a way to deliver more meaningful engagements to their customers. The rules have changed and looking to have a bigger share of your customer’s wallet will not get you anywhere. Instead, a different approach must be utilized: focusing on a share of your customer’s life. This can be realized by delivering a consistent and personalized experience across all customer touchpoints, with a strategy that combines experience design, data and technology.

Consistency and integration across channels

For a retail brand to deliver successful customer experiences, the first step is to achieve consistency across all the channels it operates on, being it storefronts or its digital presence. Just as a brand’s ethos should remain unchanged in its communications, uniformity is also key across its channels. This amplifies integrated marketing communications, strengthening reliability with customers by ensuring the brand’s values and attributes are uniformly presented across all channels.

Simultaneously, to reinforce consistency, a brand's different channels must be seamlessly connected, allowing customers to easily transition from one channel to another without loss of information or experience quality. This approach guides customers towards the smoothest experience possible. In this journey, each touchpoint plays a specific role. The services offered must be accessible across different touchpoints, consistent throughout the journey and clearly communicated.

Personalization at scale

In our previous article, we talked about how a personalized experience has become the norm for Asian consumers. When engaging a consumer to be interested in its products, a brand is expected to understand them in order to have a seamless omnichannel experience.

At its core, personalization is about recognizing and responding to the unique needs and interests of each customer. It's a strategy that transforms generic interactions into meaningful conversations, fostering a sense of individual attention and care. Given the zero consumer’s lack of brand loyalty, personalization can be an invaluable tool in nurturing a company’s consumer relationships. By analyzing their past purchases, interactions and even social media activity, businesses can tailor their communications, offering products, services and content that truly resonates with the individual.

Examine your digital footprint

When two products are similarly priced, the differentiating factor is its more intangible qualities. Coupled with stricter government regulations, this has heightened the importance of environmental sustainability, pushing brands to consider the impact of their business practices on the planet. A study by White & Case found that countries such as South Korea and India are introducing stricter ESG regulations for companies. From 2026, mandatory ESG disclosures will be required for Korean companies, while India's ESG funds must invest 80% of assets in line with ESG strategies by 2024. These steps align with a broader global push towards transparency and due diligence in supply chains.

Omnichannel payments

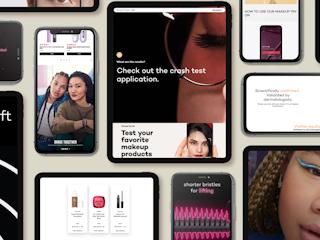

Omnichannel payments are defined as payment systems that seamlessly integrates various payment methods and channels to offer a cohesive customer experience. This includes both online and offline payment environments, such as mobile apps, e-commerce sites, physical stores and phone orders. With Gen Z consumers, an omnichannel experience is a seamless one that allows them to have a phygital presence and their past transaction history all in one place, regardless of the platform utilized. Thus, having a payments system that provides customers with options in the purchase stage not only ensures a sale but also a satisfied customer at the post-purchase stage.

To elevate their instore experience, retails brands can consider integrating a POS system tailored specifically to their needs to allow constant interaction, across all touchpoints, with both customers and staff. This allows sales assistants to consistently attend to their customer while having the necessary information at their fingertips.

Successful omnichannel experiences

Love Bonito

When Singapore thinks of omnichannel success stories, the most famous one is the homegrown brand, Love Bonito. Having started off as an online thrift store, Love Bonito expanded their operations post-COVID. Since 2022, the e-commerce fashion brand set the bar for omnichannel experiences, investing into brick-and-mortar stores with phygital spaces, while still maintaining its strong digital presence, harnessing AI and data science to tailor customer experiences.

Moreover, the brand utilizes technology to monitor their inventory effectively to prevent overproduction, thus being sustainable and omnichannel in their retail practices.

FairPrice

FairPrice Group’s innovative omnichannel strategy has led to key advancements, particularly in grocery shopping. The introduction of Digital Store Weekly Ads within the FPG App has shifted from traditional print ads to an interactive, digital format, allowing users to directly add promotional products to their carts. Since its 2023 launch, this feature has notably increased customer engagement and provided the company with valuable insights to refine the online shopping experience.

Additionally, the group has revamped its in-store checkout process. Stores now offer self-checkout stations that accommodate cashless and cardless payments, including via the FPG app. Customers can also use the Scan & Go service, scanning and paying for items as they shop to bypass queues. This enhanced process integrates seamlessly with FPG's loyalty program, Link, enabling users to earn and track points through the app. In June 2024, FPG introduced the Link+ initiative, which offers special monthly benefits for customers who reach Link+ status via the app.

Watsons Singapore

Watsons Singapore ensures its presence across multiple shopping channels, whether in physical stores, online via brand websites, mobile apps, marketplaces or quick-commerce platforms. By analyzing customer behavior, the company has introduced features to improve their O+O (Offline + Online) shopping experience. For instance, in physical stores, customers can scan QR codes and access URLs to explore a broader range of products that extend beyond the store's inventory.

To meet the growing demand for faster delivery, Watsons launched Home Delivery Express, allowing customers to receive orders within three hours by utilizing its physical store network for quick fulfilment. Shoppers can also opt for doorstep delivery or the Click & Collect option, where they can pick up online orders in-store.

Moreover, Watsons Singapore integrates social and digital platforms through in-store events and activations to enhance brand engagement, increase awareness, and boost customer interactions across multiple touchpoints.

Are you ready?

Retail brands are well aware of the technological upheaval in their industry. With such radical innovation, the barriers to entry have shifted. Transitioning to an e-commerce solution tailored to their needs and catering to their customers' new demands presents a challenge. However, once brands find a solution that suits their offerings, they can elevate their e-commerce game against competitors.

Notably, this year's eCommerce Expo Asia has just taken place, where brands met at the intersection of commerce and technology to discuss trends and solutions for innovating their e-commerce strategies. Now is the time for retail brands to explore how technology can empower their transition from multichannel to omnichannel approaches.

Valtech combines best-of-breed technologies with data-driven insights and strategic industry know-how to create commerce experiences that convert. Explore Commerce Acceleration