abril 26, 2023

The change in D2C and ecommerce market conditions that has led to significant operational challenges.

For the past decade, ecommerce and D2C brands have experienced massive growth. Consumers had more purchasing power and the overall GDP was growing almost all over the world. In Europe and the U.S., ecommerce and D2C ecommerce have been able to ride the tail wind for many years. Many people thought Covid-19 would be the shock to the market that would be the death of retail. However, that did not happen; on the contrary, less travelling was converted to buying online, and stores were heavily supported by governments. Consumer basket sizes were increasing and everyone playing in the ecommerce market around the world enjoyed fantastic results.

However, then something happened. For you as a commerce CEO, CMO or business leader in this space it is hugely important to understand what has happened, and most importantly how to act now!

Goodbye growth – Why did we end up here?

As everyone is aware, in recent years we experienced something new. Inflation started to rise, consumers' confidence started to decline, interest rates increased, logistics struggled with containerships twisted in the Suez-channel and stranded in the Chesapeake Bay, and Russia launched a devastating and immoral war in Ukraine.

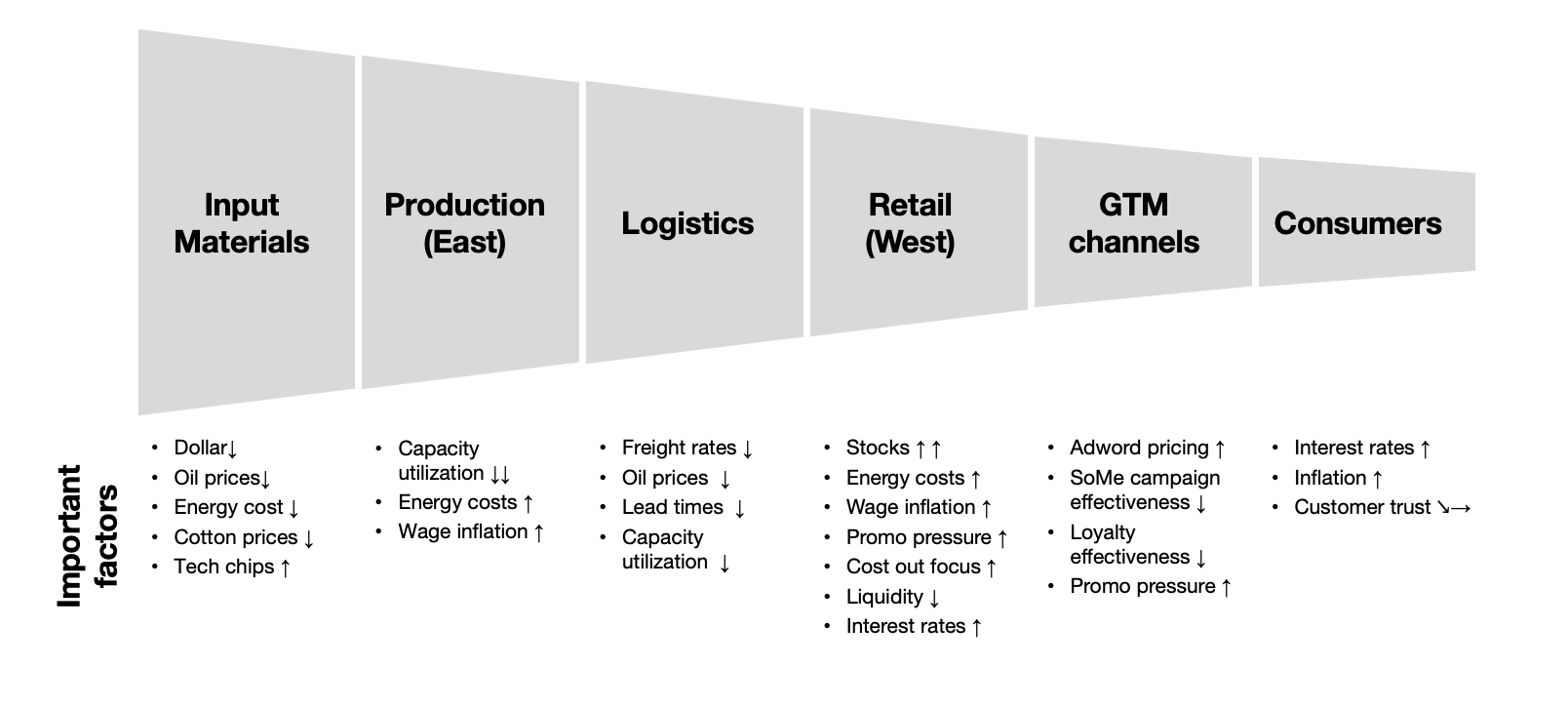

Fundamentally, there are two parameters at play that led to this being a dangerous cocktail for retail commerce. Macro factors that made supply more expensive and demand decreased. Micro elements that have led to “congestion” in the retail part of the value chain and other new “realities” for retail commerce.

E2E commerce value chain – Key factors

In general, weakening in demand has led to overstock; consumer demand is not just down in general but there are areas where buying decisions have been preempted for a long time (we can’t buy more stuff for some time because we already did buy new versions of x, y, z under Corona).

It is simple to point out many challenges in the market, but we would like to highlight a few that we sincerely believe will be key throughout the rest of 2023.

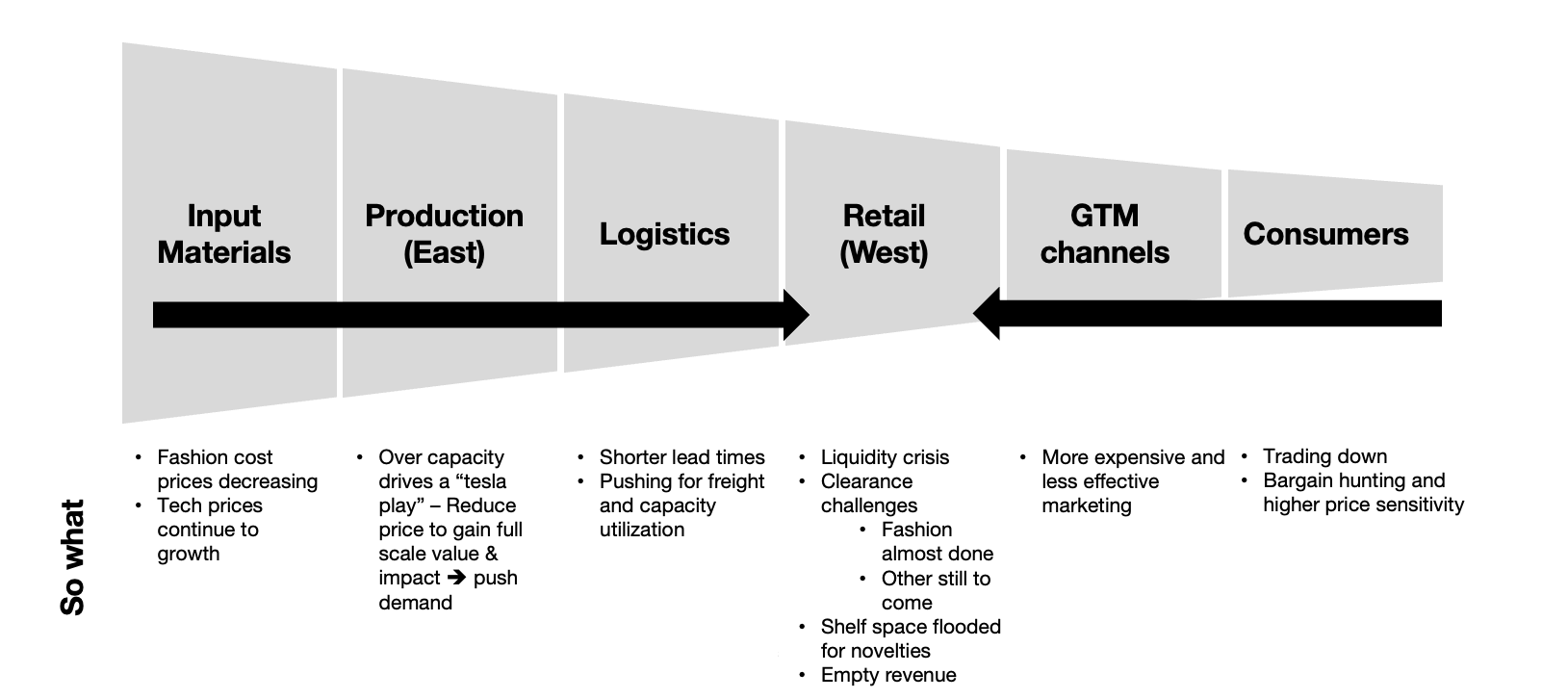

E2E commerce value chain – So what

Customers are showing signs of less loyalty and more focus on bargain hunting. With an increase in CAC, the customers you can get hold of are most likely not profitable, and your competitors need revenue to pay suppliers for excess inventory, so promotions are already active and will be massive.

On top of this, for some specialty retailers and brands within B2C ecommerce there are even further implications. Many organizations have been set up for growth rather than profitability (meaning that turning the organization around to focus on adapting the cost base and to an even more efficient way of operating can be tough).

This was the start of a new reality, where the growth imperative is gone, and many within ecommerce and D2C struggle as they need to get used to headwinds. There will still be ecommerce growth (we are just back to a trendline) and major pockets of growth are still out there, but for a foreseeable future not at the same magnitude as we saw them in the heydays of ecommerce.

Hello reality – What to do?

This has led to a seismic change in the conditions D2C and ecommerce businesses are operating under. There are new fundamental issues to address for everyone with a stake in the online retail market. This is hugely important, and anyone interested in learning more can read about it in our End of an Era blog.

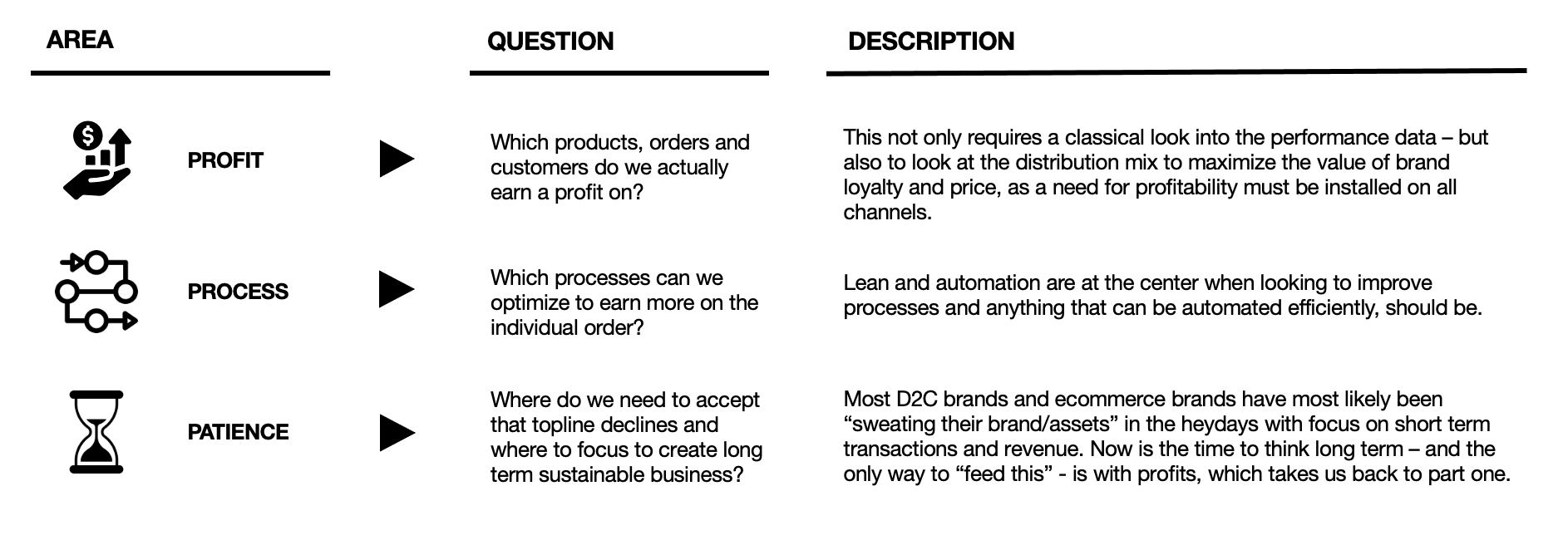

Once we recognize that the era of unlimited ecommerce growth has come to an end, the question remains: What can be done to meet the current moment? “Hello Reality” means you need to double down on some classic deeds of doing business with a short time in which to do so. We have classified these under three P’s: Profit, Process and Patience.

3 focus areas: Profit, process & patience

Addressing these three Ps is easier said than done, and there will always be nuances and differences in terms of your specific company and industry, but we are not offering five quick fixes for ecommerce. However, there is something for everyone to address now if you haven’t already done so.

Adjust marketing

One of the most important metrics for any business to understand is their CAC to LTV ratio. This is more important than ever, as several brands end up buying fewer loyal customers at too high prices. Often, focus has been on calculating the ratio, reporting it and improving your bidding based on this view.

Right now, you really need to take a step backwards and ask the question: What drives these ratios individually and how to improve them? And please do note that the times of ROAS are over. Now more than ever you need to revise your marketing mix for profit POAS. You need a full costing and customer satisfaction perspective to start running an effective marketing setup.

The focus needs to shift to acquiring highly profitable customers. Furthermore, we find it important to reduce “empty” revenue where you hit your sales target but damage your bottom line. Unless you need the cash cycle to workout payments to suppliers. Many say now is the time to invest, which can be true, but only if you have a crystal-clear business case on why.

Manage inventory

Since the Suez channel was stuck with a container ship in 2021, it has been difficult to get ordered products, and everybody ordered significant volumes of products to be sure Q4 2022 would not lack stock. Even once the crisis was ended and brands had a full stock of products, consumers did not purchase at expected volumes. Inflation and high energy prices made the situation worse as consumer sales dropped. This has given all brands a significant challenge that will not go away any time soon.

Please do note that some industries with short lead times (like fashion) have already been dealing with this, and they started before Black Friday 2022. Whereas industries with longer lead times (like Furniture) are hitting this challenge hard and head on now.

So why is this extremely critical you might ask? Here are several reasons:

- Companies need to clear this stock to pay suppliers, i.e. the need for liquidity is high.

- With massive stock comes massive promotions to get consumers to buy. This means high price pressure.

- With high stock, brands will not be able to push their novelties to market as old stock is taking up shelf space. With less shelf space and fewer potential novelties, growth will be even more challenged.

Stock/inventories are a big problem, and everyone needs to pay attention. We sincerely believe this is a shared problem between ecommerce and brands, and both parties need to find solutions to this diligently.

Clean out costs

“Never let a good crisis go to waste” has proven accurate in the past. Too often when we engage with ecommerce and D2C players, we see tools, technologies and processes that are underutilized, misused or even not used at all. Furthermore, we also see many examples of over-capacity on hosting and tech. Many companies can save massively on licenses and hosting in the tech stack. This of course differs from company to company, but there is money to save for finetuning what you already have and are paying for. Actually, companies are starting to consider downsizing platforms and technologies from best in class to mid-tier products where they can save huge amounts.

Furthermore, it’s time to review processes and P&L for costs that have emerged over the years. Ecommerce and D2C will, in the coming years, be a tough game where every penny counts. So use the crisis proactively to carve unnecessary costs.

Survival of the fittest

The new reality is characterized by: getting back to basics and finding profits, cutting out costs and delivering efficient execution (the building of value creation that should be at the core of all businesses; we all just got a little carried away). And you need to have your contingency plans in place to be capable of responding to ever-changing conditions.

Professionalisation, simplification and consolidation will be key words in years to come. At the end of the day, the new reality will reward players with efficient and scalable operations and patience. In the short term, it will be highly competitive and costly.

Goodbye growth – Hello reality!!!

About the authors:

Carsten Pingel has been working within digital strategy and business development for the last 15 years. Former experience includes acquiring and scaling high-growth, multi-brand e-commerce businesses, and enabling digital transformation in the largest Nordic media group, Egmont, business development and strategy at Copenhagen Airports, and board positions in high growth e-commerce and SAAS companies. Now Carsten is leading the strategy consulting unit within Valtech, helping companies in their digital transformation, and utilizing data to accelerate growth.

Toke Lund has been working within management consulting, heading up the strategy office and the consumer insights office at the LEGO Group, driving digital transformation at Salling Group, and working as a digital strategy consultant at Novicell. Now Toke has founded Enterspeed, a software company delivering a high-performance product called Speed layer, which can accelerate digital transformation and composable setups.