21. Juli 2022

A 100-meter sprint against one competitor seems easier to win than a marathon against many, but that is the situation most banks face today. Competition has been tough in the past, but it is getting even tougher now that neo banks have entered the race. How to win this marathon has many financial industry pundits talking, but one area that most agree on is needing to win the Customer Experience (CX) race. This blog reflects on what CX areas all banks need an answer for. But remember, these tactics are sprints, and many sprints can add up to a marathon but not without a strategic plan and a lot of training.

8 Ways to Improve Customer Experience in Banking

Customer expectations are evolving. By keeping an eye not only on the trends in digital banking but also in CX improvements across industries, you can help to improve your CX strategy and find greater digital experience success.

1. Banking Customers Need Proactive Engagement

Meeting customers where they are is helpful for every industry, but within Banking in particular a lot of customers don’t consider their options until a major purchase looms or a life event happens. Because of this proactive engagement can be crucial.

- Educate customers – Banks can provide customers a better education about their products and services by asking questions and providing answers through engaging interactive tools versus making customers search and browse.

- Notify customers – Talk to your customers regarding billing, application status, announcements to keep customers up to date about their transactions

- Survey – Proactively ask for customer feedback to identify and understand unspoken needs. But remember to respect their time, making the interaction a two-way value exchange that provides rewards for their participation.

2. Customers Expect Easy to Use Live Assistance

When mapping your customer journeys:

- Discover common complaints

- Identify all the touchpoints customers have with your bank

- Know what types and forms of communications or interactions best fit the situation

By using visual customer engagement, banks can provide faster solutions to customers in real time. Banks can also gain additional benefits like:

- Improved customer resolution time – By collaborating with customers in real time, bank reps can help to guide customers in the complex banking application processes.

- Reduced sales cycle – Having direct interaction with customers helps to identify the problem faster and deliver effective solutions on first contact.

- Decreased number of touchpoints – Live assistance helps to deliver an accurate solution by diagnosing the issue in the first touchpoint.

ICICI bank is a great example of improving customer experience in banking. By using the advanced co-browsing solution, the bank has:

- Simplified the form filling process that included multiple touchpoints and numerical mistakes.

- Decreased average operating time by 50%

- Increased customer satisfaction rate by 65%

- Improved the rate of closing contracts by 62%

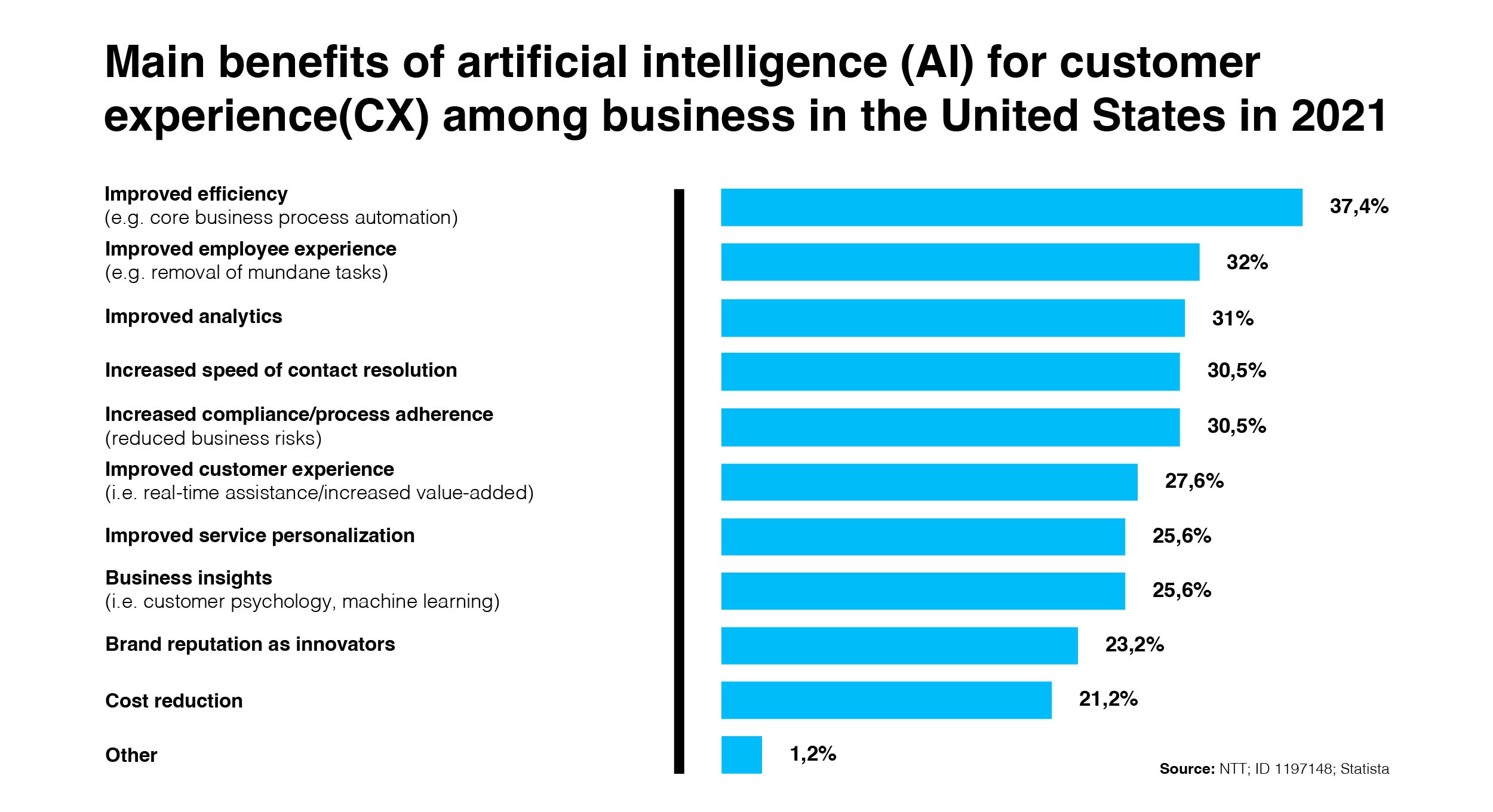

As seen in the chart above, the first three benefits of transformation are internal, but they all add up to better customer service and speedier resolutions.

3. Banks Are Understanding the Benefits of Chatbots

A chatbot is the best channel for answering customers’ simple and routine requests (knowing account balance, when a credit card bill is due, how to change an address, etc.). When bots are used wisely, they reduce support requests and improve team efficiency.

Here are a few benefits of chatbots:

- 24×7 availability.

- Interactions that are like a conversation.

- In-app chatbots can access user account details

The AI assistant applied by Swedbank, known as Nina, delivers an intuitive, automated experience using voice or text. As reported by the bank, Nina bot directly resolves 81% of the 40,000 conversations it handles each month.

4. A Strong Banking CX Strategy Must Be Omnichannel

Superior customer service is about delivering the same quality of service across all channels, both online and offline. Omnichannel banking platforms allow real-time data synchronization between different channels. For instance, customers can start the onboarding process with one channel and finish it with another, without the need to provide the same data repeatedly.

5. Improving the Banking Customer Journey

Journey mapping will help answer these key questions:

- To what extent is the current customer experience meeting customer expectations?

- Which areas need improvement?

- What new and inventive experiences could set my bank apart?

Customer needs, motivations, actions, and barriers to action should be considered at each stage of the customer journey. What motivated that person to perform that action for instance? What would motivate them to move to the next stage of the journey? What obstacles might they face?

Understanding your customer journey is essential to delivering an excellent experience in banking.

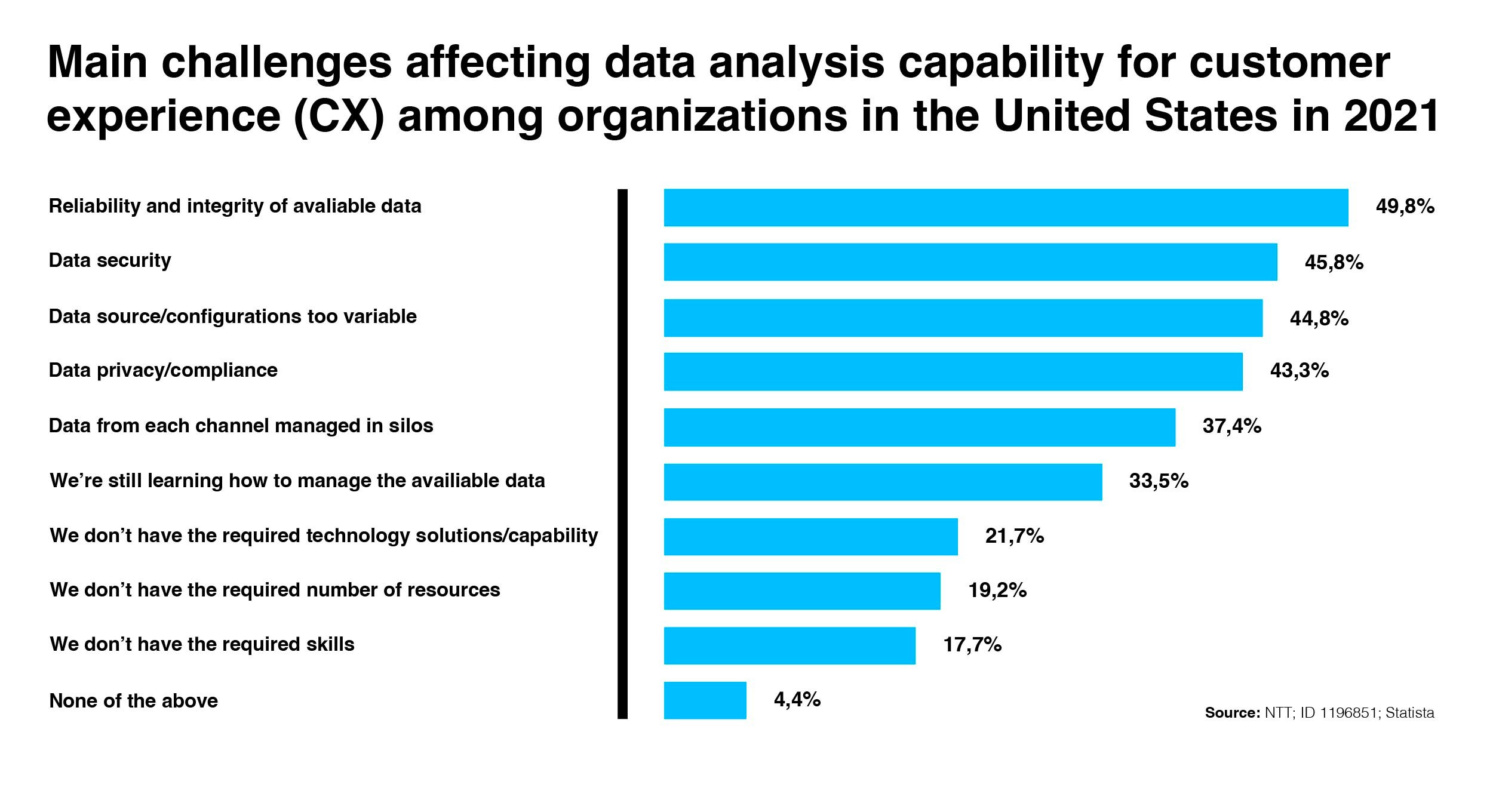

6. Improved Banking CX Requires Making Use of Data and Analytics

Data is undoubtedly the basis for any personalized experience—not only within the financial services industry. The better the quality and the higher the quantity of relevant data, the more personalized the communication and the more targeted a service can be offered.

One important analytics use case is the experience provided by Personal Financial Management (PFM) solutions. By classifying account transactions into buckets, PFM solutions use consumer history, attitude, and behavioral data to provide personalized financial advice. But collecting, retrieving and keeping data reliable and useful is a continuous challenge.

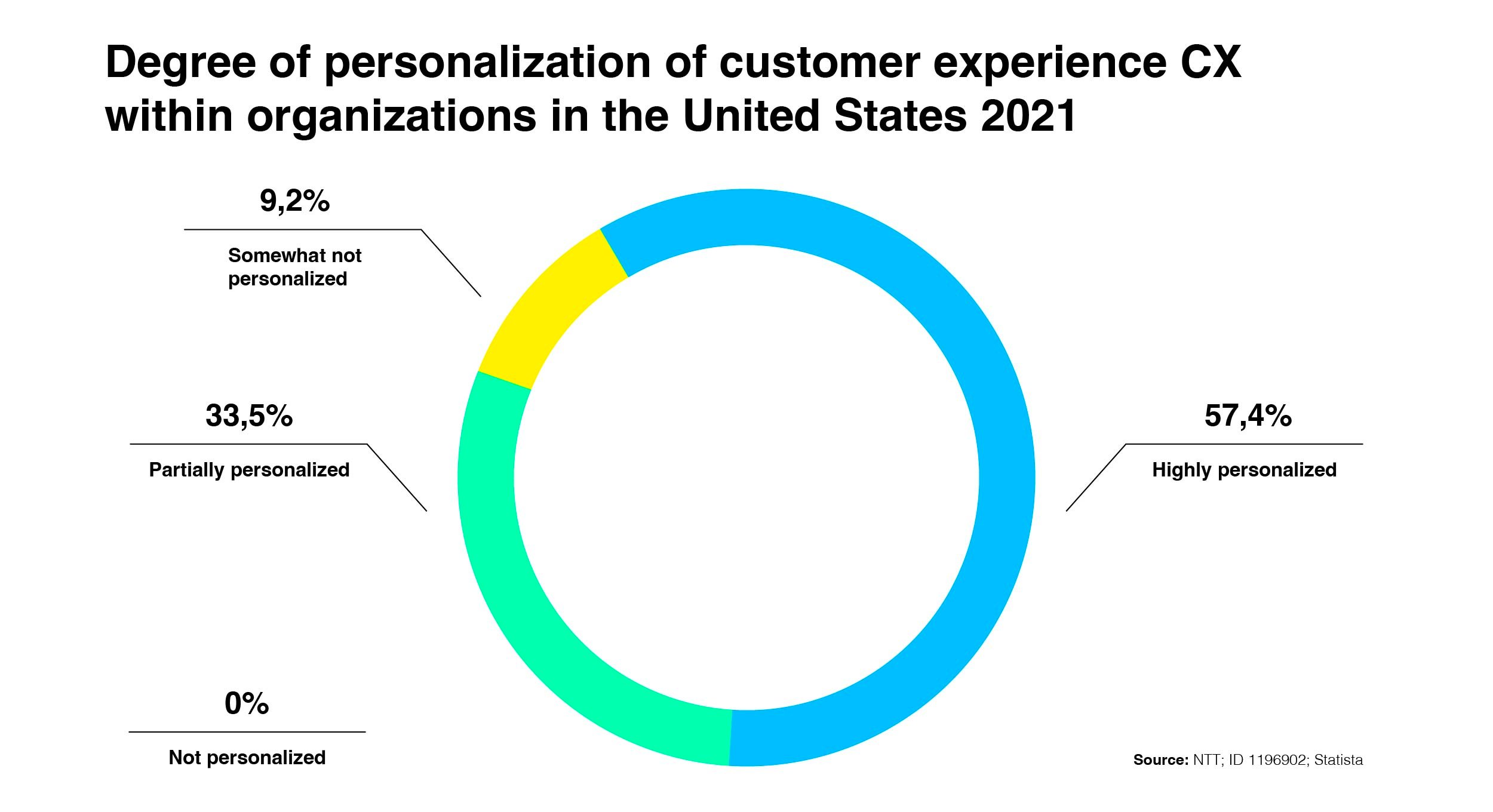

7. Creating a Personalized CX Approach

As reported by NTT, organizations across the U.S. report that 57% of their Customer Experiences are personalized. The banking industry is believed to be less than that. Here are some best practices for the banks to increase their personalized services:

- Put your customers first – Answer questions quickly and easily. Don’t ask for information outside the ask and don’t try selling services customers did not ask for.

- Leverage customer data – Customers expect you to know them and for banks to show them they know them.

8. Combine the physical and digital

- The Branch of the Future. People think it’s fun to go to the Apple Store. How many people think it’s fun to go to a bank? Banks have experimented with rows of smartphones and other mobile devices loaded up with their banking app on display, so customers can see the app in action.

- Ideally, the branch of the future should offer self-service options, community space, advanced technologies and advisory services that enable each customer to have a hyper-personalized banking experience specific to their needs.

- Reimagining the branch bank helps teach customers how to use digital services while also pairing customers with in-house financial advisors who can provide tailored advice.

Valtech has extensive experience with making physical retail spaces work with in-store digital experiences. Just imagine if exploring banking solutions could be as fun the MAC’s concept store.

So, those are the 8 ways we see that banks can improve customer experiences.

The race is not for the faint-hearted but with a CX vision, roadmap, analytics, and workforce transformation, banks can point themselves down a road that includes the realities of transformation. A vision to set a course. People not just projects. Data to help inform decisions and the attitude of a marathon runner to keep moving forward.